Everton Financial Results 2023/24.

- Matchday Finance

- 3 days ago

- 10 min read

The 2023/24 season marked Everton's 70th consecutive year in the Premier League and their penultimate season at Goodison Park.

Everton's campaign was dominated by an eight-point deduction due to two separate violations of the profit and sustainability rules (PSR). Initially facing a 10-point penalty, the club successfully appealed and had the deduction reduced to six, only to incur an additional two-point deduction for a second breach.

After narrowly avoiding relegation in the 2022/23 season, Everton had another poor start. However, their form improved before the first 10-point deduction, which saw them drop into the relegation zone. Mid-season Everton got back four of the lost points, only to be hit with the second two-point deduction later on. Despite these setbacks, a strong finish—five wins in seven games—helped them secure a 15th-place finish. Considering the circumstances, this was a good result, and without the deductions, they would have finished in 12th place.

Everton's financial struggles under owner Farhad Moshiri are well-documented. Despite investing £750 million into the club, there were times when doubts arose about Everton's financial stability, with concerns that the club might be forced into administration. A failed attempt to sell the club to 777 Partners further exacerbated the situation, marking a final blow under Moshiri's ownership.

The tumultuous era concluded in December 2024 when the US-based Friedkin Group acquired Moshiri's 94% stake in the club, making Everton the 10th Premier League club to fall under American ownership.

Overview of Everton's Financial Results

Everton's recent financial struggles led to their points deductions. Over the previous three seasons, the club incurred total losses of £256 million before tax (before accounting for any adjustments for PSR calculations). The losses continued into the 2023/24 season, with Everton reporting a £53 million loss, an improvement from the £89 million loss in the previous year.

Financial Summary for Season 2023/24:

Turnover: Increased by £15 million, reaching £187 million.

Broadcast Revenue: Rose £13 million due to a higher league finish.

Matchday Revenue: Increased £2 million due to additional matches played.

Commercial Revenue: Remained flat.

Staff Costs: Decreased by £15 million, with amortisation lower due to fewer acquisitions.

Staff Costs as a Percentage of Turnover: Although staff costs were still high at 118% of turnover, this was an improvement from last season’s 138%.

Player Sales: The sales of Iwobi, Dobbin, Cannon, and Gray generated £48 million in profits.

Exceptional Costs: £10 million was spent on costs related to the club’s sale and defending the PSR sanctions.

Loss Before Tax: £53 million, an improvement compared to the previous season’s £89 million loss.

Investment in the Squad: £55 million was invested in new players, including Beto and Chermiti.

Net Player Trading: Negative £8 million, one of the lowest in the Premier League.

Loan Support: A further £250 million in loans was provided to help fund the completion of the Everton Stadium at Bramley-Moore Dock.

Total Debts: Including shareholder loans from Moshiri, the club’s total debts exceeded £1 billion.

Stadium Investment: A total of £700 million has been invested in the new stadium.

By the end of the 2023/24 season, Everton's financial situation remained precarious. The club still had nearly £600 million in outstanding loans to fund the stadium construction, in addition to a £450 million shareholder loan from Moshiri. Operating costs continued to exceed turnover, resulting in negative operating cash flows. Despite becoming a net seller of players over the past three seasons, the club still faced significant financial losses. On the pitch, the team's struggles reflected these off-field issues.

At the time of this report, Everton sat in 15th place in the Premier League, safe from relegation and set to begin their time at the Everton stadium in the top flight. However, turnover growth for the upcoming season is expected to be minimal. Costs, such as amortisation, may decrease, and the sale of Onana should bring in around £30 million. Despite this, the club is likely to report another substantial loss, meaning managing their PSR exposure remains a key concern. It is possible they will look to sell players at the end of the season to help.

However, with the takeover now complete, the £450 million shareholder loan effectively written off, a new manager in place, and the exciting prospect of moving into the Everton Stadium next season, there is renewed optimism. The club is hopeful that it is entering a new and more prosperous era.

Everton Turnover

Everton's turnover remains highly dependent on their league position and the corresponding revenue from the Premier League. In the 2023/24 season, £129 million was generated from this source, making up 69% of their total income. Their matchday revenue stood at £19 million, ranking 11th in the league, while their commercial revenue of £39 million is approximately 13% of what their Merseyside rivals and the rest of the "Big 6" clubs generate.

In total, Everton's revenue for the season reached £187 million, placing them 13th in the league.

Everton's broadcast revenue will continue to vary depending on their league position, and while there has been some growth in matchday revenue, their commercial revenue has seen little improvement in recent seasons. This is disappointing, especially as many clubs have experienced significant growth in this area. However, there is expectation that both matchday and commercial revenue will see substantial increases at the new stadium, making it an interesting watch in the coming years.

Matchday Revenue

Matchday revenue is influenced by factors such as the number of home games, average attendance, ticket prices, and the club's ability to generate income from hospitality events and corporate boxes. The only exception to this is domestic cup matches, where revenue is shared between the clubs and the FA.

Everton's improved domestic cup performance resulted in four additional cup matches, where the club earns 45% of the gate receipts. While average attendances remained steady, there was a slight increase in revenue generated per fan, rising to £22.90 from £22 in the previous season. Overall, matchday revenue grew by 11%, reaching £19 million, making it the 11th highest in the league.

As noted, Everton anticipates significant increases in matchday revenue once they move to the Everton Stadium at Bramley-Moore Dock. Unlike some clubs, Everton has made efforts to keep season tickets affordable, particularly for younger supporters. In addition to the new stadium, they will benefit from upgraded corporate hospitality, new retail outlets, Women's matches, and the hosting of other sporting events.

While not all of these will be included in matchday revenue, with a capacity of nearly 53,000 and an expected increase in revenue per fan, it's reasonable to project this revenue stream could reach around £40 million—double the current amount. They won't be able to command the prices of the Big 6, but should be comparable to Newcastle and West Ham.

Broadcast Revenue

Everton last participated in European competition during the 2017/18 season, meaning that in recent years, all of their broadcast revenue has come from Premier League distributions.

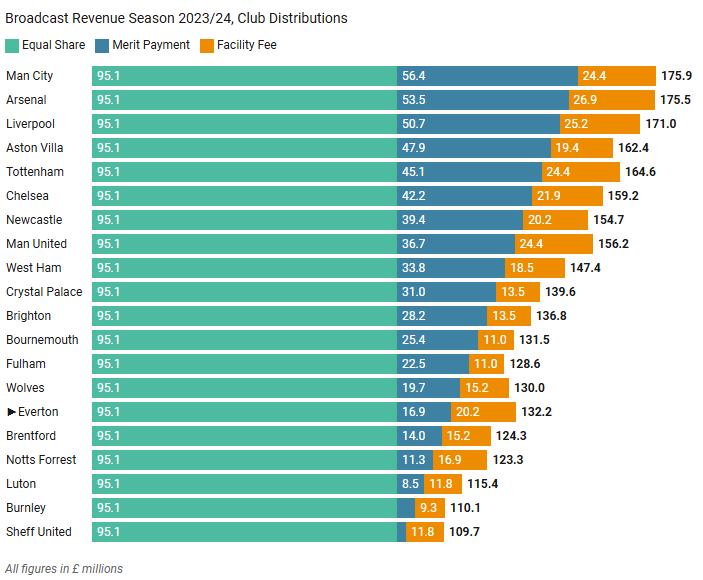

The chart below illustrates the distribution by club for the 2023/24 season. A significant portion, 67%, is evenly distributed among all clubs, with the remainder based on league position and the number of televised live games. For more information on how the Premier League central payment distribution system works check out our blog Premier League Broadcast Distribution for Season 2023/24.

Everton earned £95.1 million from the equal share, £16.9 million for finishing in 15th place, and £20 million from their 23 live televised games. This is high relative to their position, meaning they are still a popular choice for live matches.

Commercial Revenue

Commercial revenue, which includes sponsorships, retail merchandising, tours, and other activities, reached £39 million in the 2023/24 season. Like many Premier League clubs, Everton has partnered with the betting industry-Australian betting company Stake. This agreement, which covers the 'front-of-shirt' sponsorship, is valued at around £10 million per year. Interestingly, Stake no longer holds a license to operate in the UK.

The deal is set to last until the 2026/27 season, at which point Premier League clubs will be banned from displaying betting company logos and names on the front of shirts.

While revenue from sponsorship and merchandise showed a slight increase, overall commercial revenue saw little to no growth. Everton’s commercial revenue has increasingly lagged behind their peers. As recently as the 2021/22 season, Everton had the highest commercial revenue outside of the "Big 6." However, in the 2023/24 season, their £39 million in commercial revenue ranked just 11th in the league, trailing clubs like Aston Villa, Newcastle, and West Ham. They were also the only club in the league to report a decrease from the prior year.

The new owners will be keen to grow this revenue stream, leveraging the opportunities presented by the new stadium. Additionally, under US ownership, Everton is likely to see an increased international profile as the owners work to expand and strengthen the Everton brand globally.

Everton Staff Costs

High staff costs in relation to Everton's turnover have been a key contributor to their financial struggles. Although staff costs have steadily decreased over the past six years, they still stand at 118%, meaning the club has one of the highest staff cost-to-turnover ratios in the league (before player sales). This highlights the extent to which they have overspent in recent years.

Most of the reduction in staff costs has been due to lower amortisation (the write-down of player acquisition costs), as Everton’s investment in the squad has been limited by their financial challenges. For instance, in the 2018/19 season, amortisation was £95 million, but it dropped to £65 million last season.

Despite this decrease, Everton’s total staff costs of £221 million remain the 11th highest in the league. Given that they would have finished 12th without the points deduction, their performance in this regard was slightly below par.

Profit from Player Sales

Selling players for profit has become a crucial strategy—if not the key strategy—for clubs looking to reduce losses and remain compliant with Profit and Sustainability Rules (PSR). Many clubs are engaging in last-minute deals and "player swaps" to lower their staff costs. Newcastle and Aston Villa, among others, have had to take this approach. In the 2023/24 season, profit from player sales across the league grew an astonishing 60%.

Not surprisingly, Everton also reduced their losses through the sales of Alex Iwobi, Lewis Dobbin, Tom Cannon, Demarai Gray, and Ben Godfrey, with Dobbin and Godfrey being sold late in the season. These sales generated £48.5 million in profit, playing a crucial role in helping the club comply with PSR.

Everton Profit and Loss

With high staff costs relative to turnover, Everton has incurred significant losses in recent seasons, leading to their PSR breach and subsequent points deduction. Historically, the club managed its finances conservatively, often breaking even or running at a small profit. However, under Moshiri's ownership, Everton has recorded seven consecutive seasons of losses, totaling over £570 million—the highest losses of any Premier League club during this period.

In the 2023/24 season, turnover reached £187 million, a £14 million increase from the previous year. As part of efforts to reduce costs, salaries and wages decreased by £3 million, and general operating expenses (the day-to-day costs of running the club) were reduced by £1 million. This resulted in an EBITDA (Earnings Before Tax, Depreciation, and Amortization) of -£14 million, an improvement from the previous season’s -£32 million.

This marks the sixth consecutive season in which Everton has posted negative EBITDA.

EBITDA is a key indicator of operating cash flow, and negative EBITDA signals that there is no available cash for further investment without securing additional funding.

Due to financial constraints limiting squad investment, amortisation (the write-down of player acquisition costs) continued to decrease, dropping £13 million compared to the previous season. Profit from player sales, totaling £49 million, helped reduce the losses, but Everton also incurred £10 million in exceptional costs—one-off expenses related to the club’s sale process and defending against the PSR sanctions. Interestingly, Everton has had exceptional costs in five of the last six seasons, which may suggest these costs are becoming less "exceptional."

Overall, the club reported a loss of £53 million, an improvement from the £89 million loss reported in the previous season.

Only four clubs have reported higher losses for season 2023/24

Player Trading

Everton's financial situation has significantly limited their ability to invest in their squad. Over the past three seasons, they have been a net seller of players, a distinction shared with only one other club—Brighton.

In the 2023/24 season, £54 million was invested in the squad, with new signings including Chermiti, Beto, and Iroegbunam. At the same time, Iwobi, Dobbin, Cannon, Gray, and Godfrey were sold for a combined total of £63 million.

This season, Everton is once again a net seller, with Onana departing for around £50 million, while O’Brien and Ndiaye were brought in for a combined £35 million.

Football Debt

Everton has accumulated significant debt to finance the development of Bramley-Moore. By the end of the 2023/24 season, the club’s third-party debts totaled nearly £600 million, an increase of £250 million from the previous season. Additionally, there is a shareholder loan from Moshiri of £447 million, which is classified as equity in their financial accounts.

This brings Everton's total debt to over £1 billion, the highest in the league.

As part of the takeover by The Friedkin Group, the shareholder loan was converted into equity. The club also completed a comprehensive refinancing process, securing a five-year revolving credit facility with JP Morgan Chase Bank, which is expected to significantly reduce their interest payments.

These measures have placed Everton in a much stronger financial position.

Cash Flow

Since Moshiri's acquisition of the club, a remarkable £750 million of owner funds has been invested in Everton. Looking at the cash flows during his tenure, approximately £235 million of this has been allocated to the stadium and other facilities. £345 million has been spent on players, net of player sales, while the remaining £170 million has been used to cover operating losses. As previously mentioned, Everton has posted negative EBITDA, indicating that their day-to-day operating costs exceed their turnover, which is why additional funds have been required to bridge this gap.

When compared to other clubs outside the "Big 6," Moshiri's investment is the highest. However, clubs like Aston Villa, Newcastle, and Bournemouth have directed most of their spending towards player acquisitions.

Financial Outlook

While there is no doubt that Moshiri has been a generous benefactor, Everton fans will likely be relieved to see the end of the Moshiri era. During this period, substantial sums of money were invested, only for the club to fall from regular top-10 finishes to three consecutive seasons of relegation battles.

With new owners, a new stadium, and a "new" manager, there is great excitement for the start of the next season. However, the club is still facing significant losses this season, s0 they will need to continue managing their finances carefully to comply with PSR.

As the new executive chairman of Everton stated at the time of acquisition "This is a proud occasion for The Friedkin Group as we become custodians of this iconic football club. We are committed to leading Everton into an exciting new era both on and off the pitch. Providing immediate financial stability to the Club has been a key priority, and we are delighted to have achieved this. While restoring Everton to its rightful place in the Premier League table will take time, today is the first step in that journey.”

To access all the numbers and receive regular updates, sign up to the Matchday Finance platform.

Comments